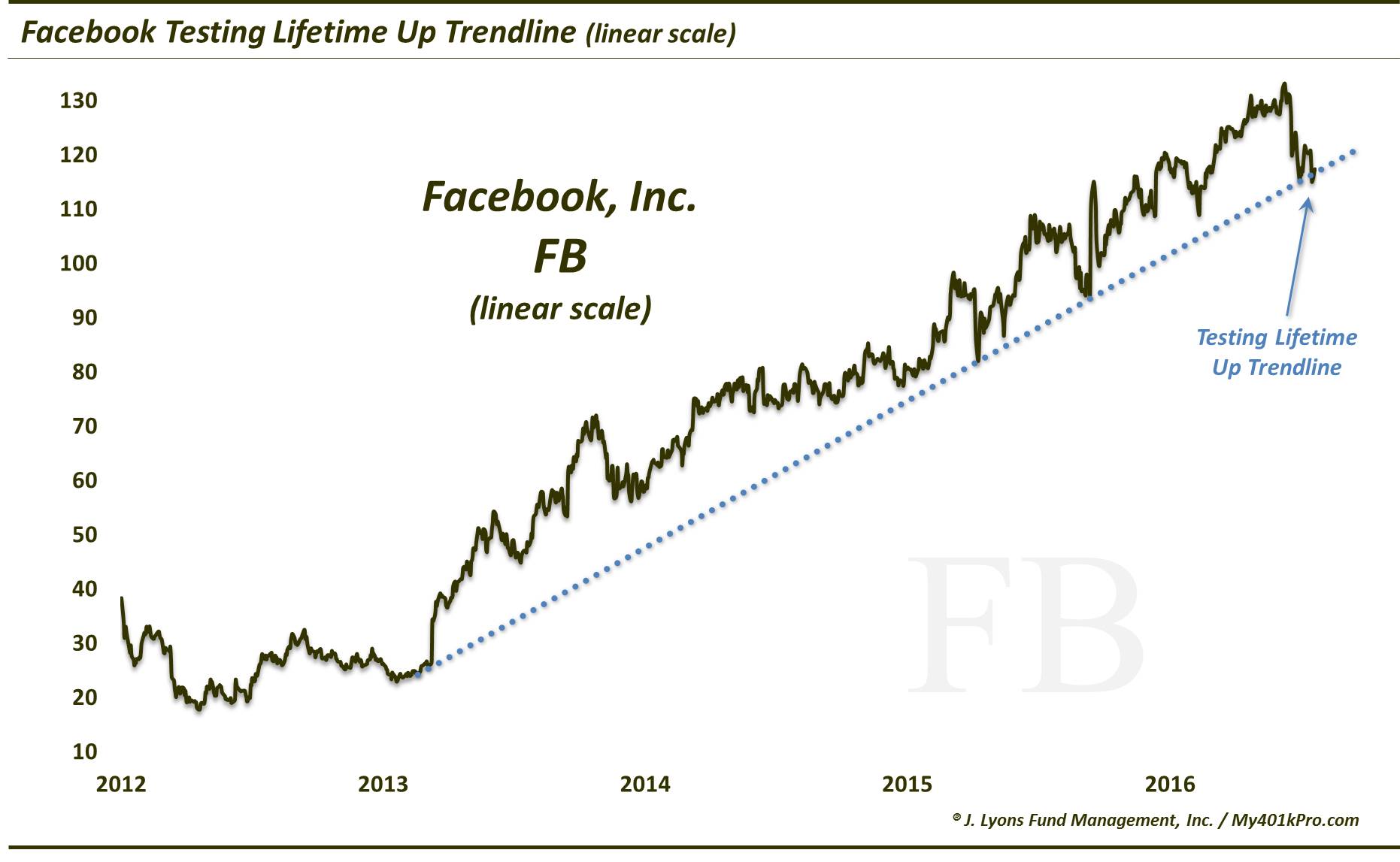

Facebook Testing Lifetime Up Trendline

Facebook Testing Lifetime Up Trendline (linear scale)

![]() Gordon Long

TRIGGER$ December 2016

Gordon Long

TRIGGER$ December 2016

Facebook Testing Lifetime Up Trendline (linear scale)

![]() Gordon Long

TRIGGER$ December 2016

Gordon Long

TRIGGER$ December 2016

THE ADVANCE-DECLINE DIVERGENCE HAS A TRACK RECORD OF PICKING CYCLICAL STOCK MARKET PEAKS SOURCE: 11-29-16 Dana Lyons’ Tumblr, Is Advance-Decline Line Divergence A Big Deal? (Spoiler Alert: Yes) Non-confirmations by the NYSE Advance-Decline Line of new market highs have often signaled major trouble for stocks – will it be the case this time? In some ways, […]

![]() Gordon Long

TRIGGER$ November 2016

Gordon Long

TRIGGER$ November 2016

The Wedge That’s Driving Facebook’s Stock

![]() Gordon Long

TRIGGER$ November 2016

Gordon Long

TRIGGER$ November 2016

FANG Stocks Lose Over $100 Billion In A Week SOURCE: 11-04-16 ZeroHedge In the last week the so-called FANG stocks (FB, AMZN, NFLX, GOOGL) have stumbled. As earnings and outlooks disappointed, shareholders have awoken to the new normal low growth world and wiped over $100 bilion in market capitalization of the four horsemen of the […]

![]() Gordon Long

TRIGGER$ November 2016

Gordon Long

TRIGGER$ November 2016

FANG & FAANG UPDATE FANG: Facebook, Amazon, Netflix, Google FAANG: Facebook, Amazon, Apple, Netflix, Google

![]() Gordon Long

TRIGGER$ November 2016

Gordon Long

TRIGGER$ November 2016

Facebook, Amazon, Netflix, Google account for 90% of Market Cap Gains Since December 2014: Tonight, Amazon Missed SOURCE: 10-27-16 MishTalk.com In an interesting tweet that shows investor herding into a small subset of high-beta stocks, Jeff Macke notes Facebook, Amazon, Netflix, and Google, collectively named (FANG) account for over 90% of S&P 500 market cap gains […]

![]() Gordon Long

TRIGGER$ October 2016

Gordon Long

TRIGGER$ October 2016

WARNING: FANGs Diverging from S&P 500

“Fab 5” US Tech Firms Now Rule Global Stocks SOURCE: 08-08-16 ZeroHedget Since the end of QE3 (Oct 2014), the broadest measure of the US equity market (NYSE Composite) is modestly lower (-1.2%). However, 5 US stocks have soared an impressive 35% since then. In fact, as Bloomberg reports, the five biggest companies in the […]

SHIFTING STRATEGIES One reason we’re seeing so much sector rotation this year is a shift in investment strategy. Momentum strategies that favored volatile tech stocks paid off handsomely last year. But that same strategy has seen a reversal in 2016, with money flowing out of those risky bets and into stocks such as utilities. Investors […]

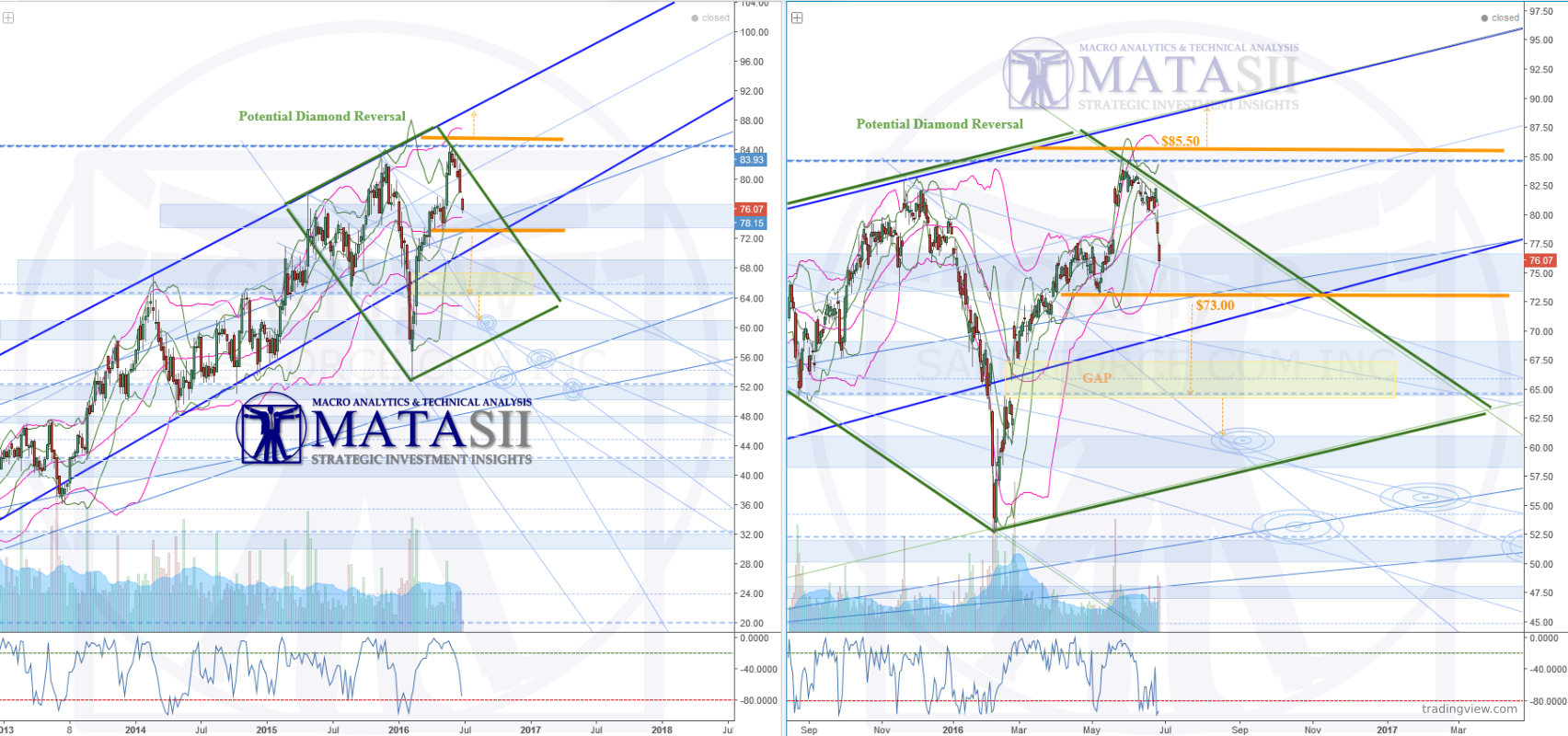

Andrew J.D. Long, MFTA

CRM IDEA

Long term up trend may be coming to an end. A double top can be seen within a potential diamond reversal pattern. Technicals offer opportunities as they are broken and the market moves to the next. Watching to see if the pattern plays out – if so then we could see a significant drop soon. […]